Teaching Kids Financial Literacy with M is For Money

November is Financial Literacy Month, and while this post is going to focus on teaching our kids about money, I suspect many of us as adults have a few things to learn as well.

I find it difficult sometimes to teach the kids about money. We certainly are fortunate to have many non-need items in our lives, and when we buy a new video game just because we wanted it, we struggle with the message that may be sending to the kids. So we try to balance that with some education about our jobs, about earning, saving, donating, and more.

We’ve tried creating an allowance, but that was hit and miss – for all of us. I would sometimes forget to track it (because frankly, there are some chores in the house that as a family we do not for payment but because we are a family unit working together) and other times, the kids just wouldn’t care enough to try to work harder to earn the few dollars I was offering up. Even if they had a goal to save their money for something, it wasn’t always enough to motivate them.

I don’t think I’m alone as a parent, trying to navigate my way through teaching them about finances and money, without stressing them out, and without making that the only focus they have for ambition.

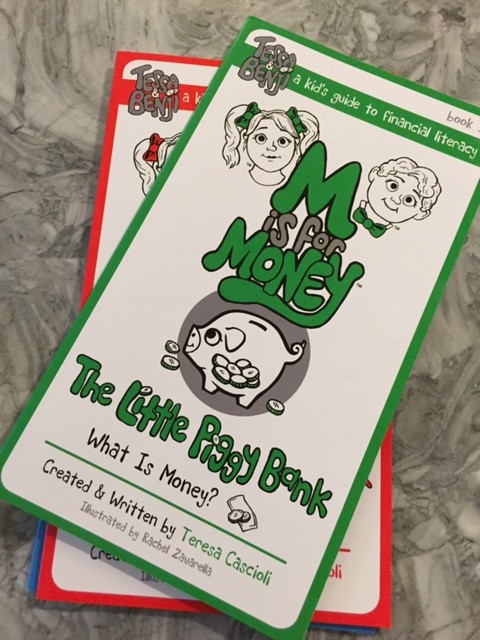

When I was offered the chance to review and write about M is for Money, I felt it was very timely. It’s a Canadian resource (yay!) that parents and teachers can purchase to help kids learn about money and financial literacy.

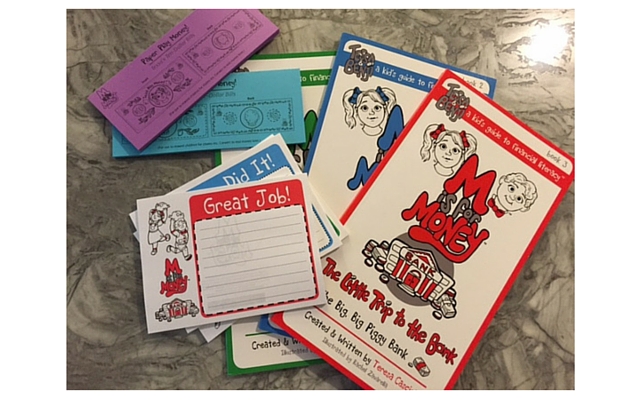

There is a series of books for the kids and parents (or teachers) to read together. The story is about two twins, aged 7, who are learning about money from their parents. They do chores, and receive an allowance. They build a lemonade stand (hooray for mini entrepreneurs!) and see the financial benefit, they head to the bank and find out about saving (because receiving money isn’t just about spending it!)

Already my youngest is showing great interest in a lot of the lessons learned in the series and I can use the play money to help motivate her. Both my kids always like the thought of starting a business to earn money, so we will see what comes of that. I’m still trying to have a breakthrough with my eldest and the ‘mom bucks’ (as he calls it) for doing chores is a hit and miss activity with him. In the months to come, if this changes I will be sure to share!

I liked how the M is for Money series is in Canadian dollars, teaches the kids about saving and earning, and that it’s not ‘speaking down’ to them. While it is aimed at their age groups (my kids are 6 and almost 9), it doesn’t ‘dumb’ down the conversations about finances.

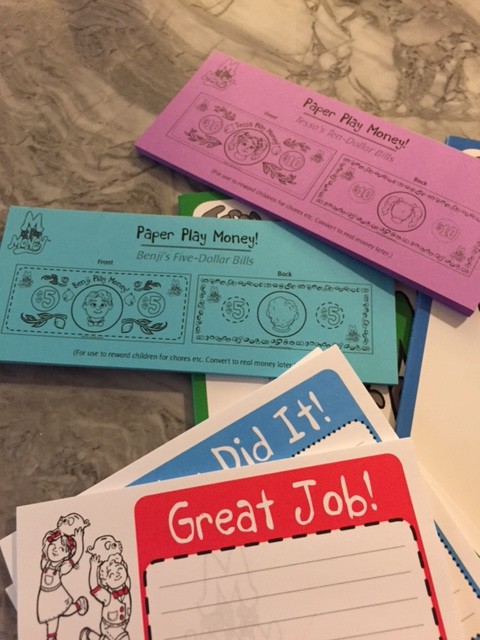

I also liked that there are activities beyond the books to read. At the end of the books are summary activities for the kids to do and the website has some free printables. The play dollars are great, much easier to keep track of than real money (and frankly, I don’t carry cash!), and there are coin printables available as well (because my chores aren’t worth $10 each. HA!)

My biggest problem I have had while starting this is less about the program itself, but more about the follow through that all of us are missing. I need to be better at using the notes and play money when they earn it, and to encourage them by bringing them to the bank and so on. Something more to get them motivated. Thankfully, the resources offered, like the note cards for when jobs are done well, the play money and activity ideas will help me do this.

While reading the books, I realized that I would love to see conversations in future books or handouts about donations and giving some money to causes that are important to us. I then noticed that in a future book, that is exactly the plan!)

The M is for Money program focuses on money, saving and spending decisions, and these books and the accompanying materials (like the play money and activities) will appeal to many kids.

This series is one that parents and kids can work on together, but I also think that teachers will be able to find some great resources here as well!

disclosure: This post was sponsored by M is for Money and I received compensation and a copy of the program. However, opinions are my own, and I’m always looking for ways to make teaching kids easier – in this case, having a support program to help teach them about money is very helpful!